Homeowners Insurance in and around Findlay

A good neighbor helps you insure your home with State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

Stepping into homeownership is an exciting time. You need to consider neighborhood location and more. But once you find the perfect place to call home, you also need excellent insurance. Finding the right coverage can help your Findlay home be a sweet place to be.

A good neighbor helps you insure your home with State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Protect Your Home Sweet Home

For insurance that can help protect both your home and your belongings, State Farm has options. Agent David Roberts's team is happy to help you set up a policy today!

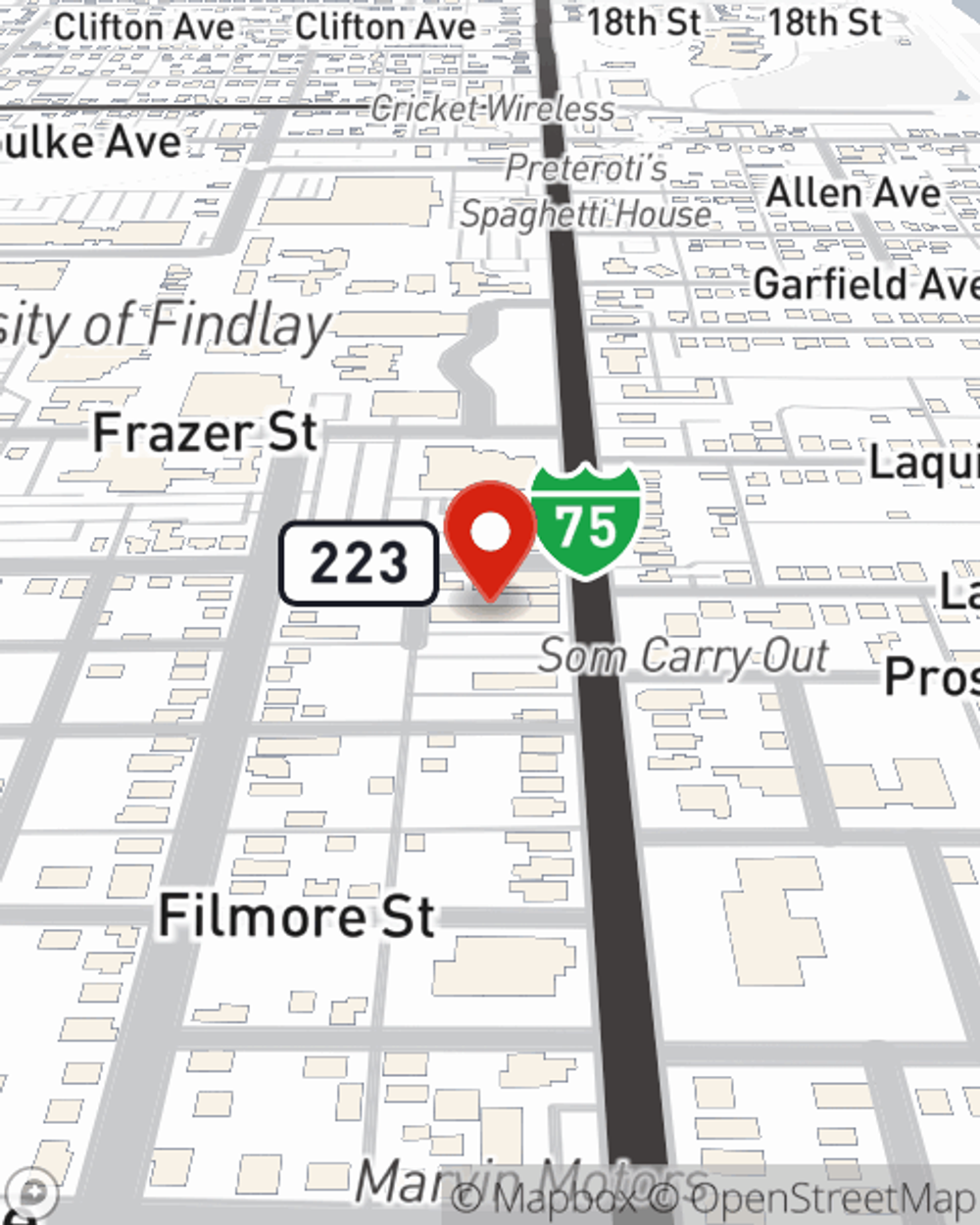

Having remarkable homeowners insurance can be significant to have for when the unpredictable happens. Visit agent David Roberts's office today to figure out what works for your home insurance needs.

Have More Questions About Homeowners Insurance?

Call David at (419) 420-7700 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Backyard structures and home insurance

Backyard structures and home insurance

Do you have detached structures or a swimming pool on your property? Learn how they're covered by home insurance.

How to prevent bug bites

How to prevent bug bites

Spider and insect bites take the fun out of being outside. Discover ways to help avoid them and what to do if you get one.

David Roberts

State Farm® Insurance AgentSimple Insights®

Backyard structures and home insurance

Backyard structures and home insurance

Do you have detached structures or a swimming pool on your property? Learn how they're covered by home insurance.

How to prevent bug bites

How to prevent bug bites

Spider and insect bites take the fun out of being outside. Discover ways to help avoid them and what to do if you get one.